Solution Architecture

A device-edge, zero-trust architecture that detects, prevents, investigates, and enables recovery from fraud in real time.

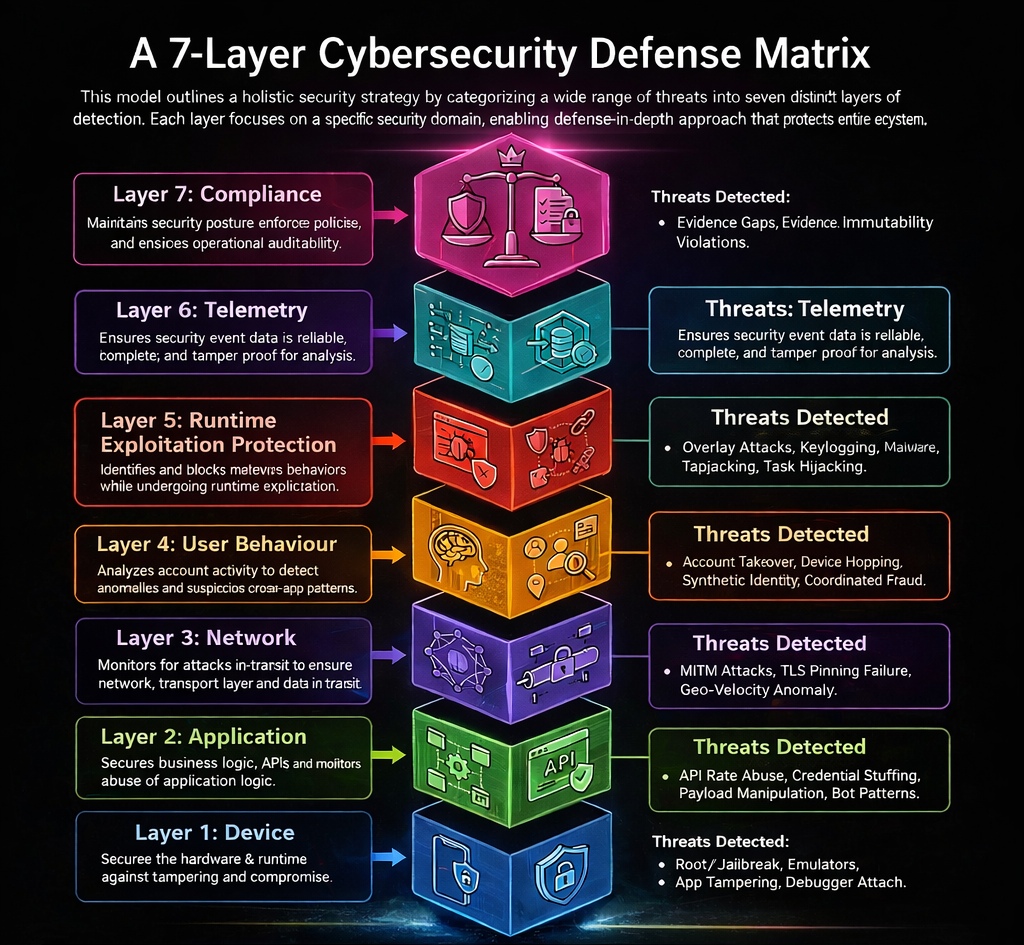

Detection Layer

Executes directly on the device to establish trust and detect threats.

- Device integrity & emulator detection

- Runtime protection (RASP)

- Behavioral & liveness analysis

- Edge ML risk scoring

Prevention Layer

Enforces real-time decisions to block fraud.

- Policy-based blocking

- Adaptive risk thresholds

- NGINX API gateway enforcement

- Zero-trust access

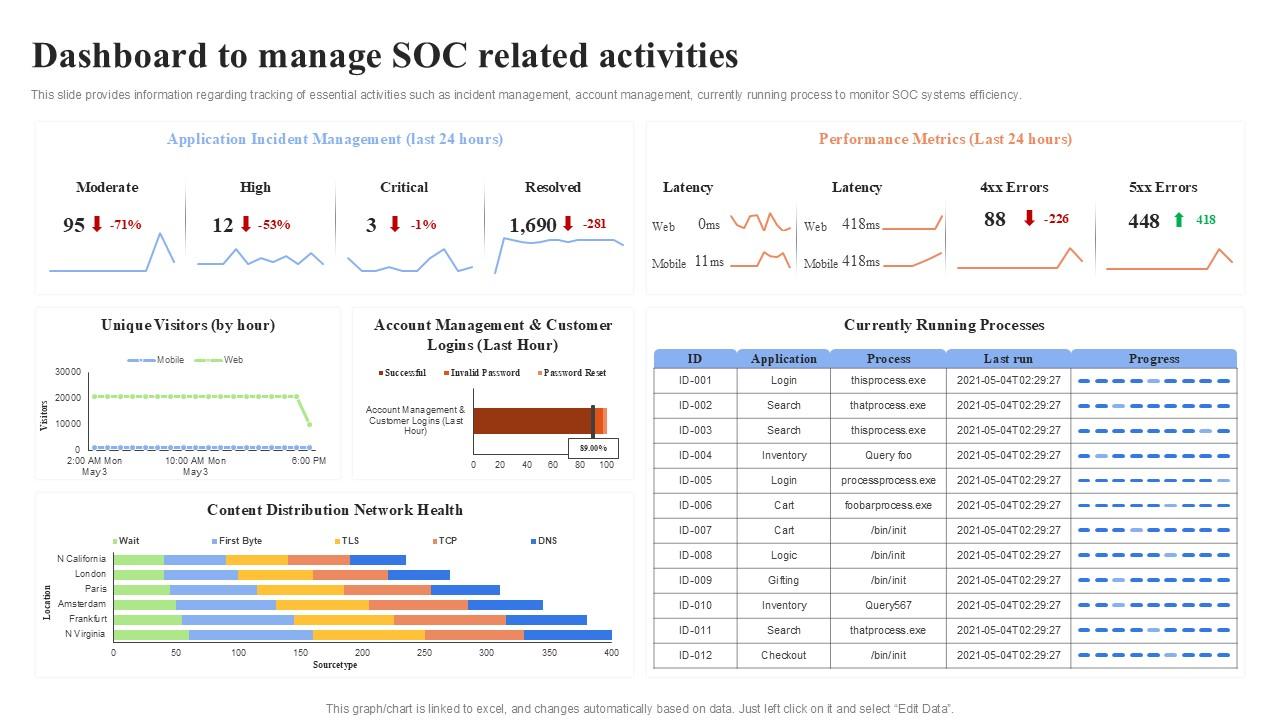

Investigation Layer

Correlates signals across sessions and timelines.

- Cross-session correlation

- Attack chain reconstruction

- Forensic telemetry

- Analyst dashboards

Recovery & Compliance Layer

Generates regulator-ready evidence.

- Device-signed evidence

- RBI & DPDP aligned reports

- Audit & SAR exports

- Secure storage